Are property prices falling in Dubai? – 2025 Forecast

Are Property Prices Falling in Dubai Real Estate Market? Trends for 2025

Dubai property prices are experiencing varied trends, with stability and slowing in some areas, while others see increases, prompting many investors and observers to question: are property prices falling in Dubai significantly soon? In this article, we’ll examine the factors influencing property prices in Dubai.

ــــــــــــــــــــــــــــــــــــــــــــــــ

Dubai Real Estate Market - Are Property Prices Falling in 2025 ?

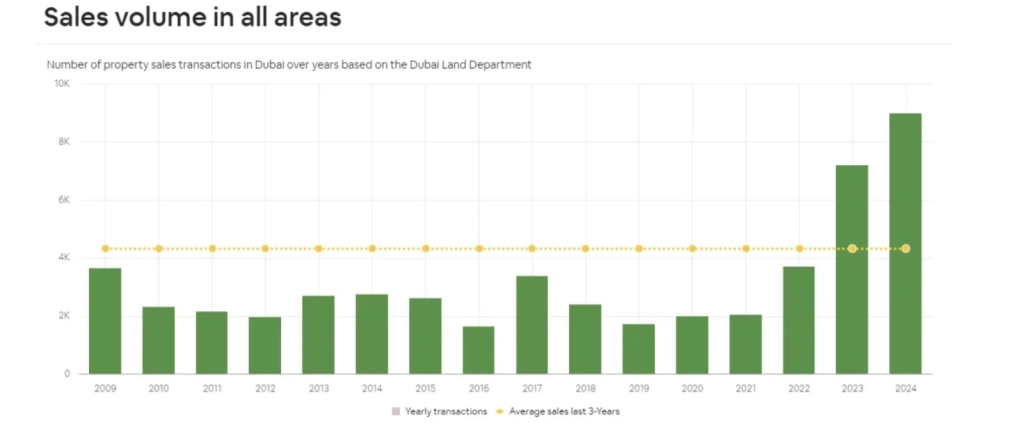

- Dubai’s real estate market continues to grow steadily. According to reports from the Dubai Land Department, real estate transactions surpassed AED 528 billion in 2023, with a forecasted increase of 10-15% by 2025. The highest growth rates are expected in areas like Dubai Marina, Downtown Dubai, and Palm Jumeirah, where property prices have been rising at an annual rate of 15-20%.

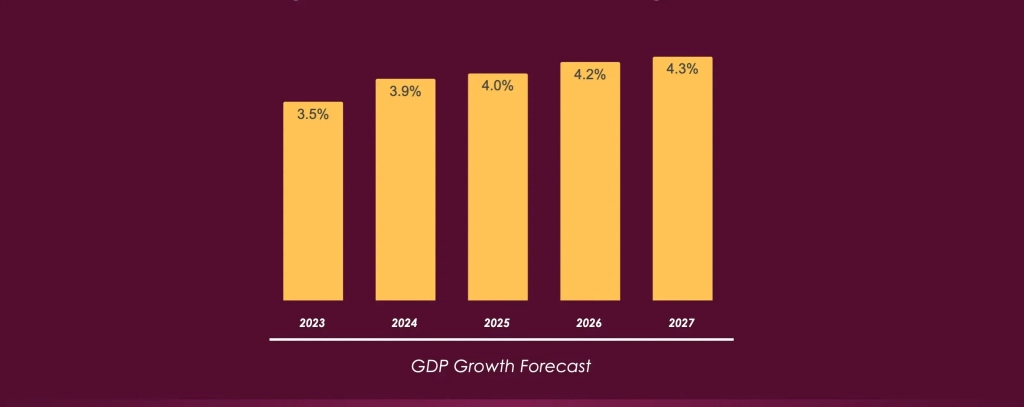

- Studies indicate that the average return on investment (ROI) in Dubai’s property sector ranges from 10-15% annually, one of the highest globally. Thanks to ongoing infrastructure development, a steady inflow of foreign investments, and government support for real estate, Dubai’s property market is better prepared to handle market fluctuations compared to the past, with strong international interest and continuous government projects.

- Overall, based on statistics and current trends, Dubai is expected to experience stable and balanced property prices with a slight increase by 2025, as apartment prices have already risen by 8.8%, bringing the average price to AED 1.3 million.

After answering the question, Are property prices falling in Dubai? we can explore

investment opportunities in Dubai.

Real Estate Investment Tips for 2025

For investors looking to enter Dubai’s real estate market in 2025, it’s essential to adopt a well-researched investment strategy. Studies show that 82% of successful investments are based on thorough market research and data analysis.

Promising areas for investment include Dubai Hills Estate, Dubai Marina, and Downtown Dubai, offering annual returns of around 7-12%. Additionally, investing in projects aligned with Dubai’s 2040 Urban Plan presents lucrative opportunities, especially in areas benefiting from infrastructure development.

It’s recommended that investors allocate 60% of their portfolio to residential properties and 40% to commercial properties to balance risks and returns.

Statistics reveal that 45% of buyers prefer ready-to-move-in units, while 55% are inclined towards off-plan projects for competitive pricing and potential for higher returns.

Read our guide on off-plan projects to find your investment.

Are Property Prices Falling in Dubai? Key Factors and Market Insights

- Supply and Demand for Real Estate:

The balance between supply and demand plays a vital role in determining property prices in Dubai. - Geopolitical Changes and Foreign Capital Inflows:

Events such as the war in Ukraine and economic crises have attracted foreign investments to Dubai, especially from Russia and China. - Government’s Role in Market Stability:

The long-term plans of the Dubai government, such as the “D33” strategy, aim to enhance the stability of the real estate market by supporting economic growth and diversifying income sources, which helps prevent sharp price fluctuations. - Population Growth:

Dubai has seen growth in its population, reaching 3.7 million in 2024, with expectations of hitting 4 million by the end of 2025. This has led to increased demand for residential properties, achieving annual rental returns ranging from 6-8% and a 20-25% increase in rental prices in key areas. Additionally, property sales have surged by 25%, providing opportunities for long-term capital gains.

Is Buying Property in Dubai in 2025 a Smart Investment?

Investing in real estate in Dubai in 2025 is seen as a promising opportunity for several reasons:

- Attractive Rental Yields: Investors can expect annual rental returns from 8-10%. Notably, average apartment rents have increased by 25%, while commercial properties have seen rental rates double.

- Potential for Capital Appreciation: There is a strong likelihood of capital gains in both the medium and long term, given the market’s current dynamics.

- Diverse Property Options: The market offers a wide range of properties suitable for various budgets, making it accessible for different types of investors.

- Tax Exemptions and Government Incentives: The government provides various tax incentives and facilitation measures for investors, further enhancing the appeal of investing in Dubai’s real estate market.

ــــــــــــــــــــــــــــــــــــــــــــــــ

Don’t Miss Out on Up to 13% Annual ROI

Register Now and Explore 1000+ Prime Projects in Dubai’s Most In Demand Areas like Dubai Marina and Dubai Hills Estate

Secure Your Future in Dubai’s Thriving Market

Your Investment Opportunity in Dubai 2025 with Daark

At Daark, we strive to be your ideal partner in exploring real estate opportunities in Dubai. Whether you’re seeking an investment or a home in one of the world’s top cities, we offer a wide selection of premium properties tailored to meet your needs.

today to embark on your journey in

Daark real estate market.

benefiting from our expertise and guidance to help you make informed and confident choices.

FAQ

Will Dubai property prices go down?

Prices are likely to stabilize, with mild increases in some areas.

Is it worth buying property in Dubai now?

Yes, strong rental yields make it a good investment.

Will property prices fall in Dubai in 2025?

A significant drop is unlikely; moderate growth is expected.

Is the property market cooling down in Dubai?

It’s stabilizing but remains attractive for investors.